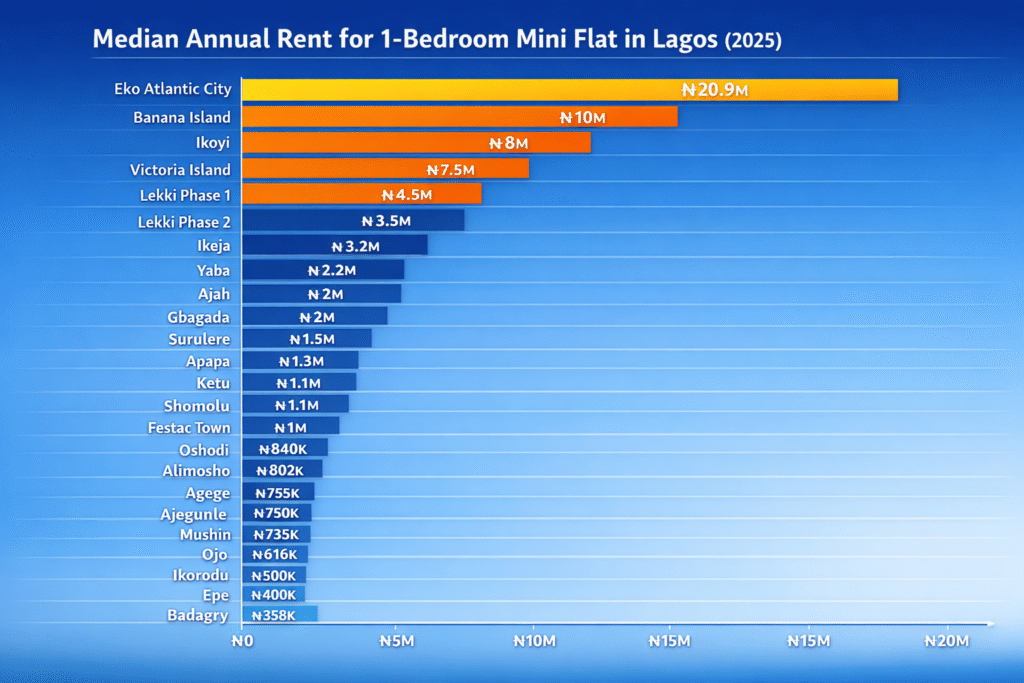

Lagos is one of Africa’s fastest‑growing cities and its property market reflects that. Whether you’re moving for work, study, or lifestyle reasons, understanding how much it costs to rent a 1‑bedroom mini flat in different parts of the city is a must.

In Lagos, landlords typically expect annual rent (paid upfront), so this guide breaks down approximate annual rent figures for key neighborhoods, what you can expect in each location, and the advantages and disadvantages of choosing that area.

To help you plan, we’ve compiled realistic annual rent ranges for 2026, along with what you can expect, pros & cons, and insights on why Lagos rent is generally on the high side.

1. Eko Atlantic City—₦20,900,000/year

Overview: It’s an ultramodern area with a reclaimed coastal city near VI. Mostly corporate and high-end living.

What you get:

- Brand-new luxury mini flats

- 24/7 security, private lifts

- Beach views in some towers

- Proximity to business hubs.

Upsides:

- Premium infrastructure

- High resale value.

Downsides:

- Pricey

- Limited community vibe.

2. Banana Island—₦10,000,000/year

Overview: It’s one of Lagos’ most exclusive residential addresses.

What you get:

- Spacious flats

- Quiet roads

- Top-notch security

- Serene environment.

Upsides: Safe, calm, and luxurious environment.

Downsides:

- It’s very expensive

- It has limited nightlife.

3. Ikoyi—₦8,000,000/year

Overview: It’s a mature island community with luxury and older buildings mixed.

What you get:

- Modern mini flats

- Access to clubs and restaurants

- Reliable utilities.

- Extremely gated and secured estates

Upsides:

- Central and with a classy environment

- A good social life.

- Your neighbors are the top 1% of the society

Downsides:

- Traffic

- Higher living costs.

4. Victoria Island—₦7,500,000/year

Overview: It’s Lagos’ central business and social hub.

What you get:

- A mix of older and new flats

- Proximity to offices, bars, and malls.

- Gated and secured estates

Upsides:

- Convenience

- Vibrant lifestyle.

- Easy access to top social hubs [filled with lots of restaurants and clubs]

Downside:

- Noise [especially at night]

- Traffic

- Limited parking.

- High living cost

5. Lekki Phase 1—₦4,500,000/year

Overview: It’s a popular middle/upper-class residential area.

What you get:

- Gated estates

- Shopping centers, cafes, gyms.

- Gated and secured estates

Upsides:

- Balanced lifestyle

- Social amenities.

Downsides:

- Traffic

- Occasional power and water issues.

- High living costs

6. Lekki Phase 2—₦3,500,000/year

Overview: It has a newer and quieter residential area just beyond Phase 1.

What you get:

- Spacious flats than Phase 1

- Greener neighborhoods

- Gated and secured estates.

Upsides:

- Affordable for Island access

- Quieter than Phase 1.

Downsides:

- Commuting to VI/Ikoyi can be long.

- Water issues [unclean water]

- Flooding [during rainy season]

- Traffic

- Occasional power issues

7. Ajah—₦2,000,000–₦3,200,000/year

Overview: It’s an Island area with a growing residential and social scene.

What you get:

- Gated estates

- Moderate facilities [due to few old houses]

- Proximity to the newly built coastal road.

Upsides:

- Affordable for Island living

- Good eateries and social spots.

Downsides:

- Traffic

- Inconsistent utilities

- It’s a distance to major business hubs

8. Gbagada—₦2,200,000–₦3,000,000/year

Overview: Mainland area bridging Yaba, Surulere, and Ikeja.

What you get:

- Modern flats

- Some gated estates

- Easy access to Mainland offices and the third mainland bridge.

Upsides:

- Central,

- Reasonable pricing.

Downsides:

- Traffic

- Older buildings in some parts.

9. Surulere—₦2,000,000–₦3,000,000/year

Overview: It’s an established Mainland neighborhood.

What you get:

- Mixed old and new mini flats

- Close to markets, schools, and bus stops.

- Proximity to the island

Upsides:

- Affordable pricing and cost of living

- It’s centrally located.

- Compared to some Mainland areas, it’s silent

Downsides:

- Congestion

- Older infrastructure.

10. Ikeja—₦2,500,000–₦3,500,000/year

Overview: Lagos Mainland’s major business and residential hub.

What You Get:

- Mixed old and new flats

- Proximity to airport and commercial centers.

- Easy access to the Island

Upsides:

- It’s a convenient environment

- It’s a lively neighborhood with access to necessary amenities

- Good transport

- Easy navigation

- Less noise in some areas [Magodo, Ikeja GRA, Isaac John street].

Downsides:

- Traffic

- Varying building quality.

11. Yaba—₦2,000,000–₦3,500,000/year

Overview: It’s a tech and student hub with high energy.

What you get:

- Modern mini flats

- Proximity to Lagos schools, start-ups, and entertainment.

Upsides:

- Social, energetic, and networking-friendly environment

- Easy access to YABAtech and Queen’s college.

Downsides:

- Congestion

- Limited parking.

12. Apapa—₦1,000,000–₦1,500,000/year

Overview: Industrial and port area.

What you get:

- Older flats

- Affordable rental

- Access to port jobs.

Upsides:

- Cheap rent and affordable cost of living

- Strategic for logistics.

Downsides:

- Industrial noise

- Traffic.

13. Ketu—₦1,200,000–₦2,000,000/year

Overview: Busy Mainland neighborhood with mixed housing stock.

What you get:

- Affordable apartments

- Access to Lagos Bus Rapid Transit (BRT).

Upsides:

- Easy commuting to most places on the mainland

- Affordable cost of living.

Downsides:

- Traffic

- Basic infrastructure.

14. Shomolu—₦1,500,000–₦2,000,000/year

Overview: Mixed residential and commercial area.

What you get: Easy access to markets and schools.

Upsides:

- Affordable environment

- Central to most areas.

Downsides:

- Infrastructure pressure

- Traffic.

15. Bariga—₦1,500,000–₦2,000,000/year

Overview: Mainland residential area, a mix of old and new.

What you get:

- Older mini flats

- Some gated estates.

Upsides:

- Affordable neighborhood

- Easy commuting to the Island

- Easy access to UNILAG.

Downsides:

- Traffic

- Inconsistent amenities

- Can be quite noisy.

16. Festac Town—₦1,000,000–₦1,500,000/year

Overview: Planned estate with community vibe.

What you get: Easy access to parks and local markets.

Upsides: Quiet and affordable environment

Downsides:

- Commute to Island is long

- Limited social life.

17. Oshodi—₦840,000/year

Overview: Busy commercial Mainland hub.

What you get:

- Older flats

- High foot traffic

- Cheap rental.

Upsides:

- Very affordable

- Centrally connected.

Downsides:

- Congestion

- Noise

- Safety concerns in some streets.

18. Alimosho—₦802,000/year

Overview: Lagos’ largest LGA with sprawling estates.

What you get:

- Older buildings

- Average amenities in mini flats

- Community living.

Upsides:

- Affordable cost of living

- Space availability.

Downsides:

- Utilities vary

- Long commutes to major areas.

19. Agege—₦1,000,000/year

Overview: Mainland suburb with a mix of older and newer estates.

What you get:

- Affordable mini flats

- Access to local markets.

Upsides:

- Cheap rentals

- Decent connectivity.

Downsides:

- Traffic

- Basic amenities

- Safety concerns in some areas.

20. Ajegunle—₦750,000/year

Overview: Working-class neighborhood near Apapa port.

What you get:

- Basic apartments

- Close-knit community.

Upsides: Very cheap.

Downsides:

- Congestion

- Infrastructure pressure

- Safety concerns.

21. Mushin—₦735,000/year

Overview: Busy Mainland area, a mix of residential and commercial.

What you get:

- Older flats

- Easy access to markets

- Transport nodes.

Upsides:

- Cheap rentals

- Accessible to most major areas.

Downsides:

- Traffic

- Noise

- Older building stock

- Safety concerns in some areas.

22. Ojo—₦616,000/year

Overview: Outer Mainland suburb.

What you get: Affordable flats, growing estates.

Upsides:

- Cheap rentals

- Spacious apartments.

Downsides:

- Long commute

- Limited social facilities.

23. Ikorodu—₦500,000–₦1,800,000/year

Overview: Expanding residential fringe area.

What you get:

- Newer estates

- Older flats

- Emerging social amenities.

Upsides: Affordable and spacious apartments.

Downsides:

- Long commute to anywhere in Lagos

- Inconsistent utilities.

24. Epe—₦400,000–₦1,800,000/year

Overview: Suburban coastal area.

What you get:

- Affordable flats

- Relaxed pace.

Upside: Peaceful and cheaper environment.

Downsides: Far from Island/VI jobs.

25. Badagry—₦600,000/year

Overview: It’s a coastal fringe town.

What you get:

- Cheapest flats

- Serene vibe

- Beach access.

Upsides:

- Affordable environment

- Scenic and beach views

Downsides:

- Long commute

- Limited facilities.

26. Ikotun—₦700,000–₦1,200,000/year

Overview: Mainland suburb with older estates.

What you get:

- Budget mini flats

- Local amenities

- Easy access to markets.

Upsides:

- It’s a cheap place to live in

- Decent transport.

Downsides:

- Traffic

- Older buildings

- Less infrastructure.

27. Igando—₦700,000–₦1,200,000/year

Overview: It’s a mainland area, mostly residential.

What you get: Affordable mini flats, growing estates.

Upsides: Budget-friendly.

Downsides: Limited commercial activity.

Why rent is expensive in Lagos

- High demand vs.limited land: Lagos is crowded; space on the Island and in high-demand neighborhoods is scarce.

- Infrastructure and amenities: New estates with generators, boreholes, lifts, gyms, and pools hike prices.

- Location premium: Being near offices, beaches, social hubs, and schools increases rents.

- Security: Gated estates, CCTV, and 24/7 guards influence rent.

- Inflation and real estate market trends: Currency shifts, construction costs, and speculative pricing all impact annual rent.

Conclusion and notes

- Prices reflect 2026 averages and vary by street, estate, and facilities.

- Rent may include or exclude light cost, agent fees, service charges, security fees, agreement and commission, legal fees, etc.

- Facilities that influence hikes: Pools, gyms, restaurants, elevators, parking, reliable water or power, landscaped gardens, and proximity to malls and schools.

- Rent ranges are guidelines; exact numbers depend on individual negotiations and availability.